Consumer Alert: Do Not Take Stock Market Tips From Known Liar Steve Kirsch

How Kirsch's paid subscribers lost money by following his 'insider' trading tips.

Here are two handy rules for smart investing:

Don't invest in things you don't understand;

Don't take stock tips from a charlatan like Steve Kirsch.

Sadly, there are people who ignored both of these investing fundamentals, and they're now poorer for it.

It all began back in November last year, when shonky Steve took time out from issuing fake challenges he had no intention of paying, to try his hand at giving stock advice.

He began enticing readers to become paid members so that they could be privy to some alleged inside knowledge he had about Moderna stock.

"Something really big is going to happen in the next 90 days," declared Kirsch.

Unfortunately, Stevie's stock advice is about as sound as his health advice, which includes taking the toxic SSRI fluvoxamine in order to combat a never-isolated virus.

Stevie's surefire stock tips revolved around shorting Moderna. I'm not a paid member of Kirsch's Substack because, well, I'm not silly. But judging from comments made by at least one unfortunate punter, it appears Kirsch was going to give an "MIT presentation" on ... something.

Conceited blowhard that he is, Steve was apparently confident this presentation would cause a seismic drop in Moderna stock and present a great shorting opportunity.

Short selling is where you bet on a drop in a security’s price. You 'borrow' a security and sell it on the open market, in the hope that you can repurchase it later for less money.

It's a risky strategy and not for beginners or the faint of heart. And it's definitely not something you should be doing on the advice of an overconfident carnival barker like Steve Kirsch.

So how did Kirsch's prediction of a big drop in the Moderna price pan out?

Here's a chart of Moderna's stock (MRNA), with my cursor positioned in early November, when Kirsch was advising his paid subscribers to short the stock:

Turns out something really big did happen - the MRNA price went up.

Right when Kirsch began advising his paid subscribers to short the stock, MRNA reversed its long decline and began trending up again.

It was yet another epic fail by Kirsch.

When attempting to reel in new paid subscribers, Kirsch promised “This is how you will feel about the information I’m about to tell you,” referring to a wonderful, racially diverse and age-inclusive picture of people jumping for joy.

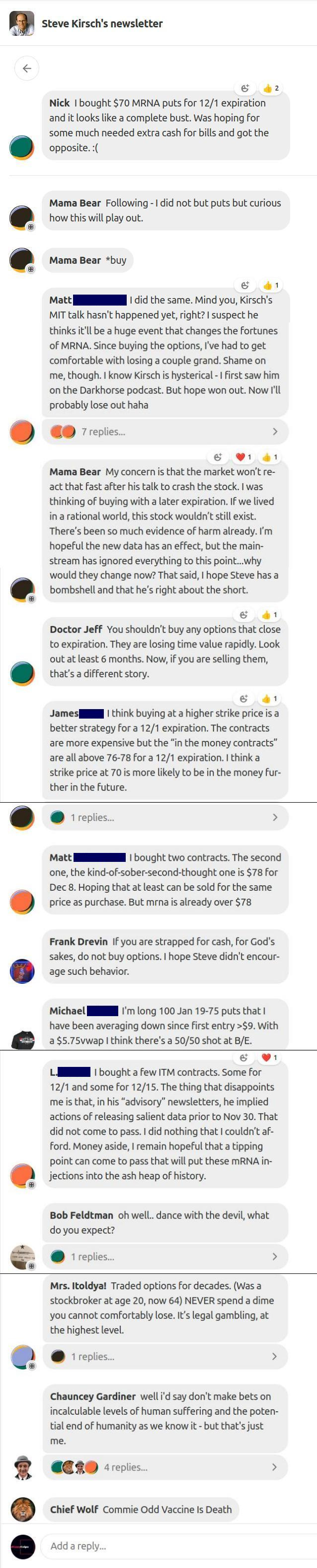

This is how people really felt after listening to Kirsch:

Here is a chat featuring some of the people who unwisely listened to Kirsch (surnames redacted to prevent embarrassment - the only person needing to be named and shamed here is Steve Kirsch):

The most innocuous scenario here is that Steve "I’m a pretty clever guy" Kirsch is an overconfident idiot who gave advice on a matter he is thoroughly ill-equipped to advise on.

A more sinister possibility is that these folks were victims of a reverse pump’n’dump. How would that work? Someone encourages people to short a stock, despite being privy to inside knowledge that the price will likely go up. When that happens, short sellers are forced to cut their losses by buying the stock, causing even more upward price pressure. Which makes for a nice profitable trade for the issuer of false information.

I can’t say if such a scenario was at play here. What I can say is that you’d have to be batshit bonkers to take stock trading advice from the likes of Steve Kirsch.

Do not take financial advice from Kirsch, and for heaven’s sake, do not take health advice from him. If you act upon his reckless advice to take the potentially deadly SSRI fluvoxamine, the end result could look like this:

A "pump and dump" stock

scheme seems highly plausible. Kirsch's Big Pharma Masters, FOR THE WIN! 🏆

If this doesn't convince his many followers he's controlled opposition.. nothing will.

Every time a layer of the duplicitous onion is peeled back, we gain a whole new level of discernment. Not just the current subject under the spotlight, but all of the other shills hiding in plain sight around us. Once you see it, you can never go back, and nothing (and NO ONE) looks the same again.

Another great one! The creep has no problem lying to people who financially support him.

I've followed Mathew Crawford for a while and just found this post that he wrote last year about Steve Kirsch and Steve's bragging about investing. Mathew has actual experience in this area (I think he was a trader on WallStreet). Mathew and Steve had a very rocky relationship due to Steve's horrible behavior (same goes for Robert Malone & Mathew). You'll enjoy the screenshots of their convos. Mathew doesn't play around, he's a real numbers guy.

https://roundingtheearth.substack.com/p/why-you-probably-shouldnt-trade-cryptocurrency